Vlbook Review: How This Digital Ledger Transforms Small Business Accounting

In today’s fast‑paced business environment, efficient financial management is no longer a luxury—it’s a necessity. Traditional spreadsheets and manual ledgers often lead to errors, time waste, and missed opportunities for growth. Enter Vlbook, a cloud‑based accounting platform designed specifically for small and medium enterprises (SMEs). This article examines how Vlbook works, its core features, and why partnering with experts like Gurubhai247 can accelerate your path to financial clarity.

Why Small Businesses Need a Dedicated Accounting Tool

Small business owners wear many hats—marketing, sales, operations, and finance. Juggling these responsibilities with outdated accounting methods can lead to:

- Data entry mistakes that affect tax filings

- Delayed cash‑flow insights

- Difficulty in generating professional invoices

- Lack of real‑time collaboration with accountants

Modern accounting software resolves these pain points by automating repetitive tasks, ensuring regulatory compliance, and providing actionable dashboards. Vlbook positions itself as a lightweight yet powerful option that balances affordability with functionality.

Key Features of Vlbook

1. Cloud‑Based Accessibility

All data is stored securely in the cloud, allowing you to access financial records from any device with an internet connection. This eliminates the need for costly on‑premise servers and provides automatic backups.

2. Automated Transaction Recording

Vlbook integrates with major Indian banks and popular payment gateways. Once linked, transactions are imported daily, categorized, and reconciled without manual input, drastically reducing bookkeeping time.

3. Comprehensive Invoicing Suite

Create professional invoices, set recurring billing cycles, and track payment status in real time. The built‑in reminder system automatically notifies clients of overdue balances, improving cash flow.

4. Tax Management Tools

GST compliance is built into the platform. Vlbook generates GST returns, maintains a detailed audit trail, and offers a one‑click export option for filing with the Government GST portal.

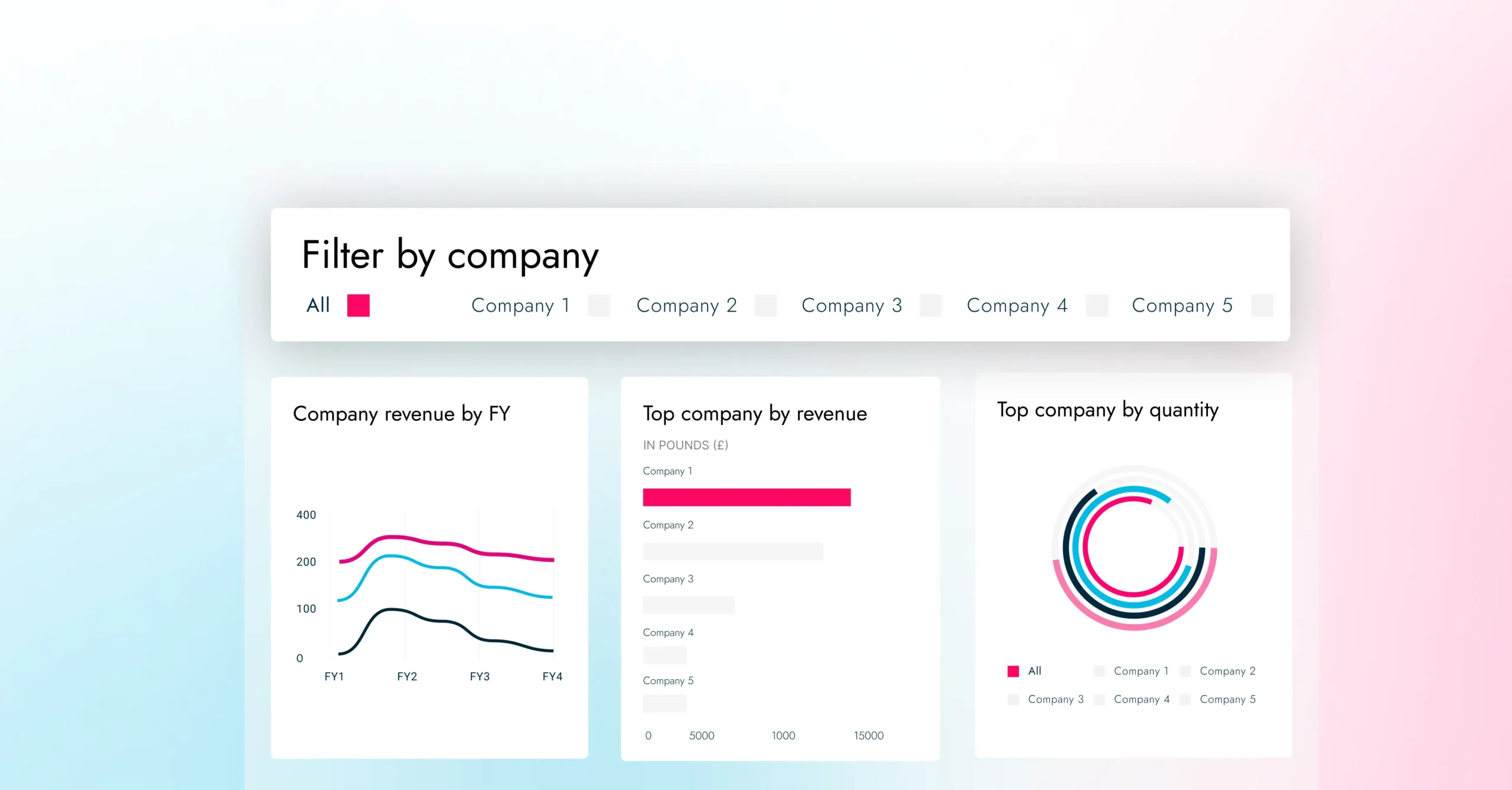

5. Insightful Reporting Dashboard

Revenue, expenses, profit margins, and cash‑flow statements are visualized through interactive charts. Export reports in PDF or Excel format for board meetings or stakeholder reviews.

6. Multi‑User Collaboration

Grant role‑based access to accountants, bookkeepers, or team members. Changes are tracked, and an activity log ensures transparency and accountability.

Integrating Vlbook with Existing Business Processes

Adopting a new accounting system can be daunting, but Vlbook eases the transition through:

- Data Migration Tools: Upload CSV files from legacy systems or import data directly from existing accounting software.

- API Connectivity: Seamlessly connect with ERP, CRM, or e‑commerce platforms for synchronized data flow.

- Training Resources: On‑board with video tutorials, webinars, and an extensive knowledge base.

For businesses that require hands‑on assistance, aligning with a seasoned consultant like Gurubhai247 can streamline setup, customize workflows, and ensure compliance with local regulations.

Case Study: How a Retail Startup Leveraged Vlbook

Background: A boutique clothing retailer, “TrendThread”, faced challenges with manual ledger maintenance, leading to delayed GST filings and inventory mismatches.

Implementation: By deploying Vlbook and engaging Gurubhai247 for consultancy, TrendThread migrated three months of historical data within 48 hours.

Results:

- Monthly bookkeeping time reduced from 30 hours to 6 hours.

- On‑time GST filing compliance improved from 70% to 100%.

- Cash‑flow visibility increased, allowing the owner to negotiate better credit terms.

The Role of Gurubhai247 in Maximizing Vlbook Benefits

While Vlbook offers a user‑friendly interface, the expertise of a professional consultant can unlock advanced capabilities:

- Customization: Tailor chart‑of‑accounts and tax categories to match specific industry requirements.

- Automation Optimization: Set up rule‑based transaction categorizations and recurring invoice schedules.

- Compliance Audits: Conduct periodic reviews to ensure adherence to GST and Income Tax regulations.

- Training & Support: Provide on‑site workshops for staff, reducing the learning curve.

Partnering with Gurubhai247 thus transforms Vlbook from a basic tool into a strategic asset.

Pricing and Value Proposition

Vlbook follows a tiered subscription model:

- Starter Plan: Ideal for freelancers and micro‑enterprises; includes basic invoicing and GST filing.

- Growth Plan: Adds multi‑user access, advanced reporting, and API integrations.

- Enterprise Plan: Custom pricing with dedicated account manager and priority support.

Even the Starter plan remains competitively priced, delivering a high return on investment by shaving hours off manual bookkeeping and reducing costly compliance errors.

Conclusion: Is Vlbook Right for Your Business?

For SMEs seeking a reliable, cloud‑native accounting solution, Vlbook offers an attractive mix of automation, regulatory compliance, and scalability. When paired with professional guidance from Gurubhai247, businesses can accelerate implementation, fine‑tune processes, and maintain financial health with confidence. In a landscape where every minute counts, investing in a modern ledger system is not just a smart choice—it’s a strategic imperative.